What Exactly Is A Utility Bill?

In 2025, understanding your business’s utility bills is more important than ever. Rising costs, tighter regulations, and a growing demand for sustainability have placed utility management at the forefront of business operations. But despite their importance, many business owners still ask the same basic question: what are utilities bills, and why do they matter?

What Are Utilities Bills?

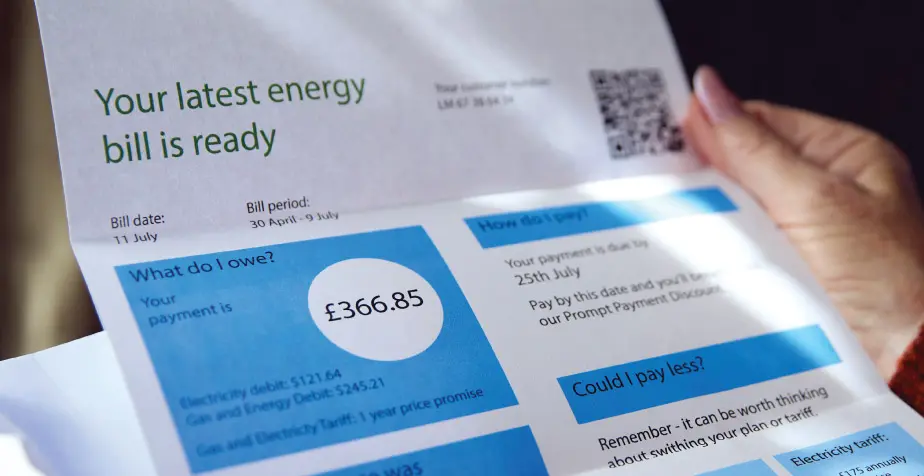

Business utilities bills are regular invoices that businesses receive for essential services such as electricity, gas, water, and telecommunications. These services keep your operations running day-to-day, yet many businesses only glance at their bills before paying them, without digging into the details. A utility bill outlines exactly how much your business has consumed over a set period and the rate you’re being charged for that usage. It also includes fixed costs like standing charges, environmental levies, and taxes such as VAT.

The most common utilities billed to UK businesses are electricity, gas, and water. These form the core of what we refer to as “business utilities.” In some industries, additional services like telecoms, broadband, or waste collection are bundled into utility agreements, but at its simplest, a utility bill shows what you’ve used, what it costs, and what you owe.

Why Utility Bills Matter for Your Business

For many businesses, utilities bills represent a significant proportion of operational expenses. If you’re not actively managing and reviewing these bills, you could be overspending without even realising it. Many companies don’t realise that utility tariffs vary widely between suppliers, and what you pay may not reflect the most competitive deal available. That’s why taking the time to compare business utilities isn’t just a good idea, it’s a critical strategy for cost control.

In an age where businesses face constant pressure to reduce overheads and operate sustainably, being able to read and understand your utility bill gives you leverage. It helps you identify billing errors, spot inefficiencies, and negotiate better terms. Just as important, it helps with long-term financial planning. Predicting your energy and water usage, and managing it effectively, can improve cash flow and operational resilience.

Information about utility bills and how your charges have been calculated must be provided by your supplier in an accessible and intelligible way according to The Electricity and Gas (Billing) Regulations 2014.

Understanding the Charges on Utility Bills

Every utility bill is made up of several cost components. First, there is the unit rate, which is the price per unit of energy or water your business uses. These rates are typically measured in kilowatt-hours (kWh) for electricity and gas, and in cubic metres for water. Rates vary depending on your contract, location, and usage levels. As of 2025, average business electricity rates in the UK are around 25.6 to 26.6p per kWh, while business gas rates range from 7.3p to 8.3p per kWh.

In addition to usage charges, there’s a standing charge, which is a fixed daily fee for maintaining your connection to the utility network. These charges apply whether you consume anything or not and can vary significantly between providers.

Your bill will also include taxes and levies, such as VAT, usually at 20%, and the Climate Change Levy (CCL), which applies to most non-domestic energy usage. These additional costs are designed to fund energy efficiency schemes and discourage excessive consumption, particularly from carbon-intensive sources.

What Happens After I Receive My Utility Bill?

The next logical step to take once you receive your utility bill is to pay it!

If you are unsure of anything or unable to pay your bill, you can contact your provider. If you feel you need more support or advice, you can contact Citizens Advice.

There are a variety of payment options depending on your supplier, such as:

– Making Payments Online

– Paying Via The Supplier’s Mobile App

– Paying Over The Phone

– A Direct Debit Payment.

What Can Affect The Price I See On My Utility Bill?

Many things can alter the final price of your utility bills, depending on what contracts you have with your suppliers. For instance, with fixed gas contracts, market fluctuations are not an affecting factor. The one factor which will impact the final price is the amount of your consumption. Below is a brief overview of common factors which can impact utility bills.

Environmental Factors

Ongoing severe weather conditions such as storms can damage power lines, and disrupt distribution systems, The cost of repairs can result in suppliers raising prices, which raises the cost of your utility bill.

Another way weather can affect your utility bill is extreme temperatures, e.g. during heatwaves, businesses tend to increase air conditioning usage, whilst in winter there is higher heating usage. This higher consumption is reflected in the price of bills.

Political Unrest

The ongoing Russia-Ukraine conflict has impacted energy prices, causing many companies to raise their prices. This has a knock-on effect for businesses that have seen an increase in their utility bills as a result.

For example, Russia is the second largest producer of natural gas. Following the invasion of Ukraine, Russia was subject to economic sanctions which restricted exports of natural gas. There have been fears in the headlines of power blackouts from the National Grid, and although unlikely, remains a possibility during peak hours between 5 pm and 8 pm if demand exceeds supply.

Market Changes

Market changes can stem from all these factors. For example, when the raw materials to create energy increase in price, suppliers increase prices to match the rise in their production costs. Some utility bills may be more directly linked to market changes depending on your contract type, such as variable-rate contracts, where prices are dependent on the market.

How to Compare Business Utilities Effectively

One of the most effective ways to reduce costs is to compare business utilities on a regular basis. Doing this allows you to see what other suppliers are offering and ensures you’re not stuck on a rollover tariff or outdated deal. Energy and water markets have become increasingly competitive in the UK, and switching suppliers is often simpler than business owners expect.

You can use tools like Tariff.com to compare providers, review contract terms, and get impartial advice. Switching may unlock lower rates, greener tariffs, or more flexible billing arrangements that better suit your business model. Whether you’re a small retail outlet or a large-scale manufacturer, there’s no one-size-fits-all when it comes to utility contracts.

The Role of Water Bills and Potential Reforms

Water bills, while often less variable than energy bills, are still a significant part of a business’s utility costs. They typically include charges for water supply and sewerage, based on actual or estimated usage. In 2025, there’s growing debate around reforming how these charges are applied.

Recent discussions include proposals to eliminate standing charges in favour of rising block tariffs, which would penalise excessive use and reward efficiency. According to The Times, this approach aims to make bills fairer while incentivising conservation. For businesses with high water usage, understanding these changes will be vital in the coming years.

Managing Business Utilities in a Smarter Way

Understanding what your utilities bills are telling you is just the beginning. The next step is managing your consumption intelligently. Many businesses now install smart meters and monitoring tools that provide real-time data on energy and water usage. With this information, you can pinpoint wasteful practices like leaving lights or machinery on after hours and take immediate action.

Another important aspect of utilities management is checking your bills for accuracy. Errors can and do happen, from incorrect meter readings to misapplied tariffs. If something looks off, challenge it. Many businesses recover hundreds or even thousands of pounds in overcharges simply by questioning discrepancies.

For those new to this area, our Beginner’s Guide To Business Utilities offers a comprehensive overview to get started.

Why Paying Attention to Utility Bills Pays Off

In 2025, business utilities aren’t just a background cost, they’re a controllable, optimisable aspect of running a smart, lean organisation. Whether you’re looking to save money, improve sustainability, or ensure you’re getting the best deal, it all starts with understanding your utility bills. By reviewing your usage, comparing providers, and challenging inaccuracies, you gain control over your costs and can make smarter decisions for your business.

So, what are utilities bills? They’re more than just numbers on a page. They’re a window into how your business operates and a powerful tool for improving the way it runs.

Business Utility Bills With Tariff

At Tariff, we work with trusted supplies to provide your business with the utilities of gas, electricity, and water. Our energy switching service can cut costs and secure your business with a better deal, lowering your overall utility costs. We are here to support your business with switching to the right providers whilst minimising your carbon emissions. On top of that, we will never pressure you to make a decision that isn’t optimal for your business needs.

Tariff can also help manage and cut your utility usage, providing cost-effective solutions that work for you and your business needs. Our consultants are here from the initial consultation to the very end of your contract, to provide support in your transition and management of utilities.

Switching gas suppliers with Tariff is an effective way to decease costs and your carbon footprint, and help you reduce expenditure with a smart meter.

Choosing to switch electricity suppliers with Tariff saves you money on future contracts, getting you the best deal on business electricity.

To help your business get the best from your water supplier, contact Tariff for independent recommendations and take control over your water utility bill. Our water audits will not only analyse your bills but calculate if you are overspending with your current provider. Tariff can also make recommendations on how to improve efficiency, saving on usage and business costs.

Contact our team at Tariff.com today for a free consultation and to get started on your journey to easier, more efficient utilities!